In the face of global economic and geopolitical uncertainty, worldwide IT spending is projected to grow by 7.9% in 2025, reaching $5.43 trillion, according to the latest forecast by Gartner, Inc. This increase – driven largely by ongoing artificial intelligence initiatives – comes amid what Gartner analysts describe as a deliberate “uncertainty pause” in new investment across multiple sectors, including IT.

Despite the pause, IT budgets remain intact. Rather than slashing funding, enterprises are choosing to delay net-new investments as they navigate increasingly volatile global conditions. Gartner’s analysis suggests that this caution is not rooted in shrinking resources, but rather in strategic restraint. Companies are opting to reallocate existing budgets, focusing more heavily on AI and digital transformation rather than expanding into uncharted territory.

John-David LovelockJohn-David Lovelock, Distinguished VP Analyst at Gartner, explains that the momentum behind AI – particularly generative AI (GenAI) – is strong enough to counteract the broader investment slowdown. “Ongoing AI and GenAI digitization initiatives are subsuming the effect of a business pause on net-new spending due to a spike in global uncertainty,” he noted. While growth in spending on software and IT services is expected to slow in 2025, investment in AI-specific infrastructure – such as AI-optimized data center systems – is accelerating.

John-David LovelockJohn-David Lovelock, Distinguished VP Analyst at Gartner, explains that the momentum behind AI – particularly generative AI (GenAI) – is strong enough to counteract the broader investment slowdown. “Ongoing AI and GenAI digitization initiatives are subsuming the effect of a business pause on net-new spending due to a spike in global uncertainty,” he noted. While growth in spending on software and IT services is expected to slow in 2025, investment in AI-specific infrastructure – such as AI-optimized data center systems – is accelerating.

AI-optimized servers, a niche almost non-existent just four years ago, are poised to triple the investment levels of traditional servers by 2027. This transformation is reshaping enterprise infrastructure priorities and putting pressure on CIOs to build future-ready environments that can support compute-heavy AI workloads. Lovelock describes this as a “surge in data centers,” fueled by the expanding footprint of GenAI.

Overpromises of GenAI

Between March and May 2025, Gartner surveyed 252 senior business leaders from organizations with annual revenues exceeding $500 million across North America and Western Europe. The findings reveal that 62% of CEOs and top executives view AI as the defining force in business competitiveness over the next decade. Furthermore, 64% of respondents said that technology investments are now being driven more by the need to stay competitive than by transformation for its own sake.

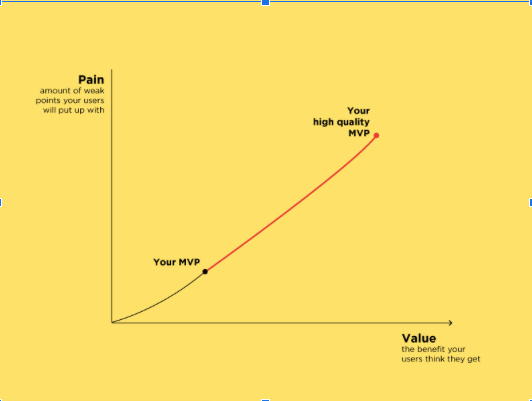

This trend coincides with growing disillusionment around the overpromises of GenAI. While vendors are eager to promote GenAI functionality as a plug-and-play solution, buyers remain cautious. CIOs, according to Lovelock, are showing greater interest in GenAI features from incumbent providers but are holding off on major purchases, seeking clearer, more actionable use cases before committing.

The economic backdrop for this shift is increasingly complex. Since the second quarter of 2025, IT departments have experienced a noticeable slowdown in new investments, a trend Gartner labels the “uncertainty pause.” Global businesses are responding to heightened geopolitical risks and economic instability with measured restraint, even as they recognize the strategic necessity of digital advancement.

Supply Chain Disruptions and Inflation

According to Gartner’s research, while 61% of companies began 2025 in a stronger position than the previous year, only 24% expect to close the year ahead of plan. Senior executives identified economic disruption (41%) and geopolitical instability (32%) as the top two business risks. In contrast, issues such as customer demand, competitive pressure, and regulatory compliance were seen as more manageable.

Interestingly, routine IT expenditures, particularly in cloud computing and managed services, appear resilient. The impact of supply chain disruptions and inflation is being felt most acutely in the hardware and infrastructure segments. Enterprises continue to fund critical operations but are slowing discretionary expansion, reflecting a wider shift in IT strategy from growth to optimization.

Gartner’s forecast is underpinned by a comprehensive analysis of market behavior and input from over 1,000 global IT vendors. The firm combines primary and secondary research to build its database, forming the basis of its quarterly projections. The current data points to a tech investment landscape that is evolving – cautiously but decisively – toward a future shaped by AI, even amid mounting global instability.