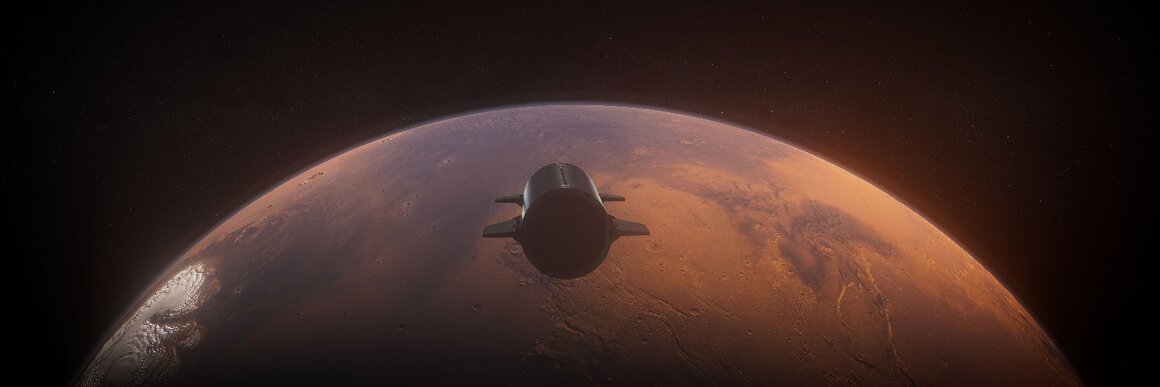

EchoStar is preparing for one of the most significant spectrum transactions in recent years, announcing that it has reached a definitive agreement with SpaceX to sell its AWS-4 and H-block spectrum licenses for a package worth about $17 billion.

The deal, which is still subject to regulatory approval, will consist of up to $8.5 billion in cash and an equivalent amount in SpaceX stock, valued at the time of signing. In addition, SpaceX has agreed to fund roughly $2 billion in cash interest payments tied to EchoStar’s debt through late 2027, a provision that underscores the scale and strategic nature of the agreement.

The move represents more than just a spectrum transfer. EchoStar and SpaceX will also establish a long-term commercial partnership that directly integrates the assets of both companies. Under the terms, EchoStar’s Boost Mobile subscribers will gain access to SpaceX’s forthcoming Starlink Direct to Cell service through EchoStar’s cloud-native 5G core. For consumers, this could mean the first mainstream step toward ubiquitous satellite-to-phone coverage, a concept long envisioned but only recently within technological reach.

Executives from both firms framed the deal as a turning point for mobile connectivity. EchoStar President and CEO Hamid Akhavan pointed to his company’s decade-long strategy of acquiring spectrum and supporting global 5G standards with the expectation that direct-to-cell connectivity would fundamentally reshape communications. “This transaction with SpaceX continues our legacy of putting the customer first,” he said, arguing that pairing EchoStar’s spectrum holdings with SpaceX’s launch and satellite infrastructure would accelerate delivery of this vision to market.

Ongoing Regulatory Pressure

Gwynne Shotwell, President and COO of SpaceX, echoed that sentiment, highlighting the humanitarian and practical benefits already demonstrated by Starlink’s first-generation satellites. She cited examples where Starlink has provided lifelines during natural disasters or in remote areas traditionally beyond the reach of terrestrial mobile networks. With exclusive spectrum now in play, she said, SpaceX plans to deploy next-generation Direct to Cell satellites with a significant performance leap designed to close mobile coverage gaps worldwide.

For EchoStar, the agreement also addresses ongoing regulatory pressure. The company said it expects the transaction, combined with a previously announced spectrum sale, to resolve inquiries from the Federal Communications Commission. Proceeds will support debt retirement and fuel growth initiatives, while existing operations under brands such as DISH TV, Sling, and Hughes will remain unaffected.

The companies have lined up heavyweight legal advisors to navigate the process. EchoStar is working with White & Case LLP and Steptoe & Johnson PLLC, while SpaceX is represented by Gibson Dunn & Crutcher LLP and HWG LLP. Closing will depend on obtaining regulatory clearance and meeting other standard conditions, but if approved, the deal has the potential to redefine not just the fortunes of the two companies involved but also the broader trajectory of global mobile connectivity.