The global data center landscape is undergoing a significant transformation, with hyperscale operators rapidly consolidating their dominance in terms of capacity. According to the latest data from Synergy Research Group, hyperscale firms now control 44% of total global data center capacity, up from just over a third six years ago.

This shift marks a fundamental reconfiguration of the digital infrastructure landscape, with major implications for enterprises, colocation providers, and hardware vendors alike.

As of the end of Q1 2025, Synergy reports that 1,189 large-scale data centers are operated by hyperscale companies – massive cloud and internet firms that include global leaders in search, e-commerce, social media, and platform services.

More than half of the capacity these operators consume now resides in data centers they own and build themselves, rather than those leased from colocation providers.

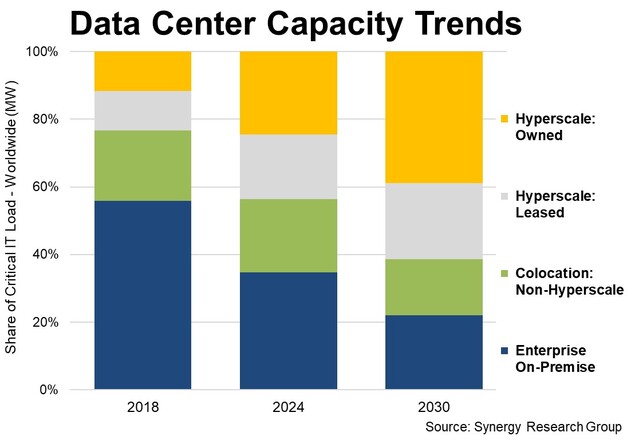

The remainder of the global data center market consists of 34% on-premise enterprise data centers and 22% non-hyperscale colocation capacity. Just six years ago, on-premise infrastructure made up 56% of total capacity.

By 2030, this share is expected to drop to 22%, while hyperscalers will command 61% of the total, reflecting a seismic shift in how digital services are hosted and delivered.

Multiple Converging Trends

The forecasted expansion is driven by multiple converging trends. Hyperscale data center capacity is projected to triple over the next six years, largely fueled by the proliferation of AI-driven applications, increased cloud adoption, and demand for compute-heavy workloads like generative AI and large language models. Although on-premise data centers have seen minimal growth in recent years, interest in high-performance computing and AI infrastructure is beginning to reverse that trend, causing a modest uptick in deployments. Still, their relative share of global capacity will continue to shrink by approximately two percentage points per year.

Colocation providers will also see steady, if slower, growth. Though their market share is expected to decline in proportional terms, absolute capacity will increase at close to double-digit rates annually, according to Synergy. This sustained growth signals ongoing enterprise reliance on hybrid IT models and the strategic role of colocation in delivering edge computing, latency-sensitive services, and regulatory compliance.

Synergy’s data is drawn from extensive tracking of over 320 colocation firms and detailed analysis of hyperscale and on-premise infrastructure by geography and service provider. This includes insights into infrastructure owned by top-tier firms offering IaaS, PaaS, SaaS, and other cloud-native solutions.

John Dinsdale, Chief Analyst at Synergy Research Group, highlighted the growing influence of artificial intelligence on data center build-outs. “The dramatic rise of AI technology and applications is now providing an additional impetus for data center capacity expansion, which has been primarily driven by cloud and other key digital services,” he noted.

Regional disparities remain pronounced. Hyperscale-owned capacity is most concentrated in North America, particularly the United States, while the EMEA and APAC regions still lean more heavily on leased facilities and on-premise infrastructure. However, the global trend remains consistent: double-digit growth in overall data center capacity and an accelerating shift toward hyperscale footprints. Synergy expects hyperscale capacity to increase by over 20% annually in every major global region through 2030.

This realignment of digital infrastructure suggests a future where hyperscale operators set the pace for innovation and scalability in IT services. For enterprises and technology providers, the challenge will be to adapt to a market increasingly defined by cloud-first architectures, AI-driven demand, and the declining centrality of legacy on-premise systems.